December '22 Grading Recap

January 2nd, 2023

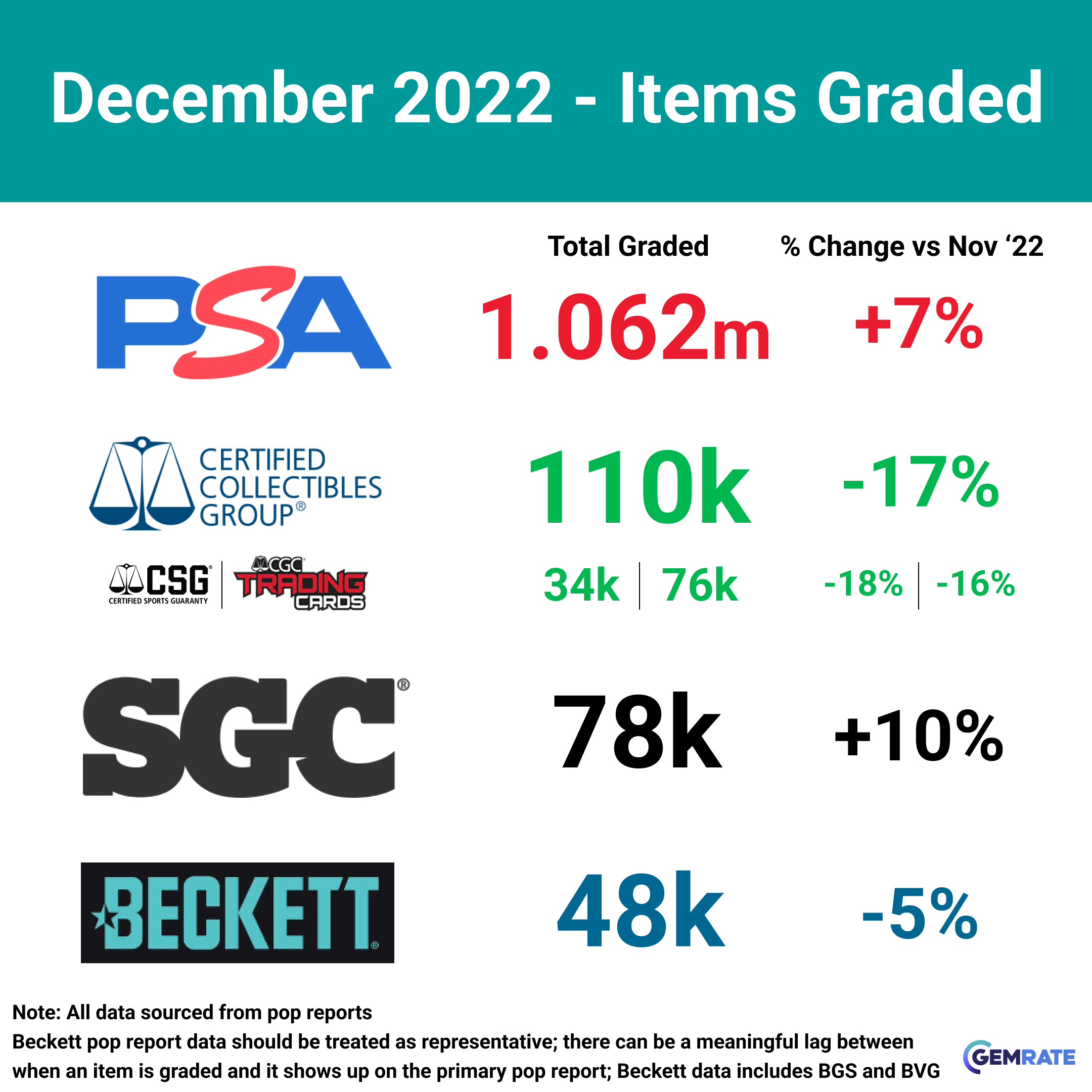

- Overall grading activity reached 1.3 million and increased by 4% in December vs November.

- PSA and SGC output increased by 7% and 10%, respectively; Beckett output dropped by 5% while the combined CSG/CGC dropped by 17%.

- TCG continues to lead at the category level and crossed 400k cards graded at PSA during December.

- Baseball (+22%) and hockey (+10%) saw the largest increases across the major categories.

December Grading Summary

Items Graded - Monthly in 2022

Items Graded - Monthly in 2022 - Excluding PSA

Category Comparison

TCG Cards Graded at PSA

Items Graded by Era

Gem Rate Breakdown by Era

December 2022 PSA Grading Recap

- PSA graded 1,062,123 items during December; output was up 7% vs November and up 37% year-over-year.

Category Summary

TCG carried PSA activity again in December

- TCG continues to lead at the category level and crossed 400k cards graded at PSA during December.

- Baseball (+23%), basketball (+12%), and hockey (+11%) all outpaced overall growth during December.

Set Summary - Sports & Other

2021 Prizm basketball grabs the top spot

- Added to the list in December: 2021 Donruss Optic basketball

- Dropping from the list: 2021 Donruss football

Set Summary - TCG+

1999 Pokemon Game stays #1

- Added to the list in December: 2022 Pokemon Swsh Black Star Promo, 2022 Pokemon Sword and Shield Lost Origin, and 2021 Pokemon Japanese Promo Card Pack 25th Anniversary Edition

- Dropping from the list: 2019 Pokemon Sun & Moon Hidden Fates, 2000 Pokemon Rocket, and 1990 Marvel Universe

Player Summary - Sports & Other

Michael Jordan activity dips but holds the top spot by a nearly 2x count

- Added to the list in December: Julio Rodriguez and Jalen Hurts

- Dropping from the list: Mac Jones and Anthony Edwards

Subject Summary - TCG

Charizard activity continues to grow

Card Summary - Sports & Other

2022 Topps Update Julio Rodriquez leads the way

Card Summary - TCG

Ultra-modern Pokemon continues to dominate the leaderboard

What's Next for PSA?

- PSA put together another strong month to close the year as grading activity continues to be led by TCG. In general, PSA output was much more consistent to close out the year as the company moved beyond the backlog and started to navigate more recent submissions.

- January will be an important month for PSA as the company retires its 3-month long $15 pricing special. In addition to relaxing its promotional activity, PSA also announced a new, streamlined pricing structure that takes effect in January.

- We expect grading output to remain healthy as the company works through the new mini backlog that was accumulated during the fourth quarter of ’22. That said, January submission volume will give PSA a quick read on what the current steady state of grading looks like and how well their new pricing fits that demand.

- PSA used much of 2022 to explore pricing levers and likely has more to pull. January will set the tone for how quickly the market should expect to see more on that front.

December 2022 SGC Grading Recap

- SGC graded 78,086 cards during December - a 10% increase vs November.

Category Summary

Baseball (+37%), non-sport (+43%), hockey (+42%) and multi-sport (+18%) all outpaced overall growth in December.

Set Summary

2022 Bowman Chrome baseball claims the top spots

- Added to the list in December: 2022 Bowman Chrome and Bowman Chrome Prospects baseball, 2022 Topps Update baseball, and 1961 Topps

- Dropping from the list: 2021 Donruss Optic basketball, 2021 Prizm and Select football, and 2020 Select football

Player Summary

Michael Jordan narrowly hangs on to the top spot

- Added to the list in December: Kobe Bryant, Wander Franco, Nolan Ryan, and Ken Griffey Jr

- Dropping from the list: Josh Allen, Justin Herbert, Trevor Lawrence and LeBron James

Card Summary

What's Next for SGC?

-

SGC closed the year with good momentum on the heels of its partnership with Topps related to 2022 Bowman Chrome.

While we do not know how well the promotion performed versus expectations, SGC did out-grade PSA with that specific set in December (note that PSA may have many more cards in the queue while the SGC queue is mostly exhausted).

-

Overall, SGC was far less promotional on price relative to its competition during 2022.

The Topps partnership highlighted one way SGC can hold prices yet increase its relevance in the market.

Like PSA, SGC is testing and building out ways to drive demand and we expect to see them continue to build on this type of effort early in 2023.

Other Charts - CSG

Category Summary

Set Summary

Player Summary

What's Next for CSG/CGC?

- CSG and CGC both saw modest declines in activity during December. While there doesn’t appear to be a singular reason for the decline, the more competitive environment likely continues to chip away at both companies' momentum.

- Overall, CSG/CGC had a productive 2022. CSG was able to effectively put the slab design commentary behind them and solidify itself as a relevant player in the market. CGC had a strong foundation and has been able to expand its output on the back of the TCG wave.

- For CGC, it is likely more of the same in 2023 - keep pushing harder on things that are working and expanding their coverage.

- For CSG, the levers are not quite as obvious. Beyond pricing (where CSG is already an inexpensive option), how will CSG push to make noise? The company has mentioned international expansion as an opportunity. We look forward to seeing what else is on the roadmap.

Other Charts - Beckett

Category Summary

What's Next for Beckett?

- Beckett remained active with pricing specials in December; however, the company saw a small drop in grading activity despite those efforts. Given that, December looks like a bit of a mixed bag for Beckett.

Beckett was mostly able to hold its own during the month, but pricing leverage seems less material for the company in its current state.

- The themes for Beckett remain the same. The company has great brand recognition and a huge installed base of Beckett slabs in the market.

Many in the market want Beckett to succeed. That said, the company lost momentum as it failed to modernize at a rate required by the market.

While it is important for Beckett to continue to show that it has leveled up on many of the basics required to be relevant, the company needs to find more ways to stand out and show the market they get it.

- As mentioned, 2022 was a year of testing and learning for PSA and SGC. At the same time, it was a year of recalibration for Beckett.

We expect Beckett to push harder to find their own ways to cut through the noise.