June 2022 Grading Recap and YTD Update

Published July 5th, 2022

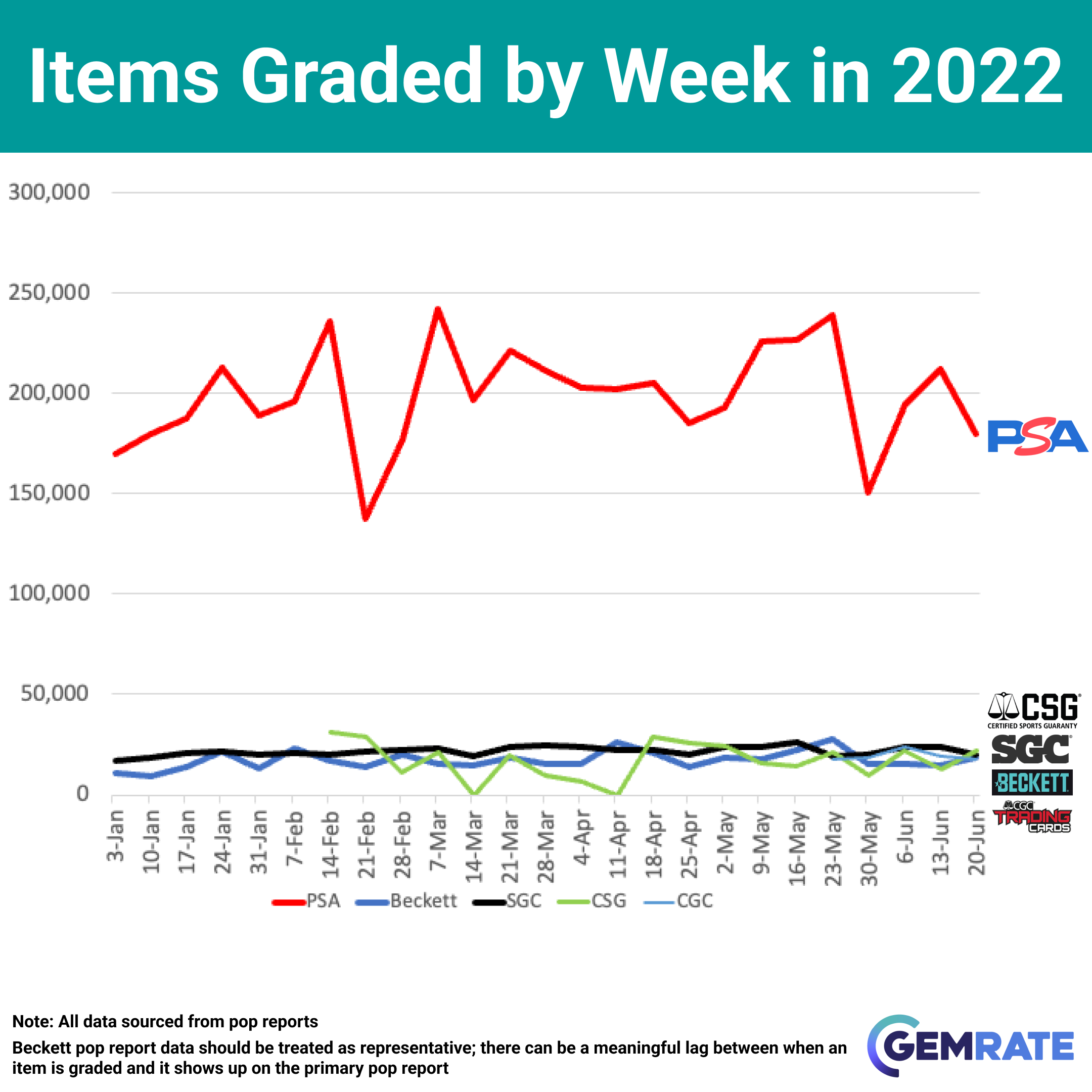

- Over 1.23 million items were graded across the major graders in June - roughly flat vs May.

- PSA graded 887,723 items during June - flat vs May.

- The combined CSG/CGC increased 12%, SGC increased 5%, and Beckett declined 18%.

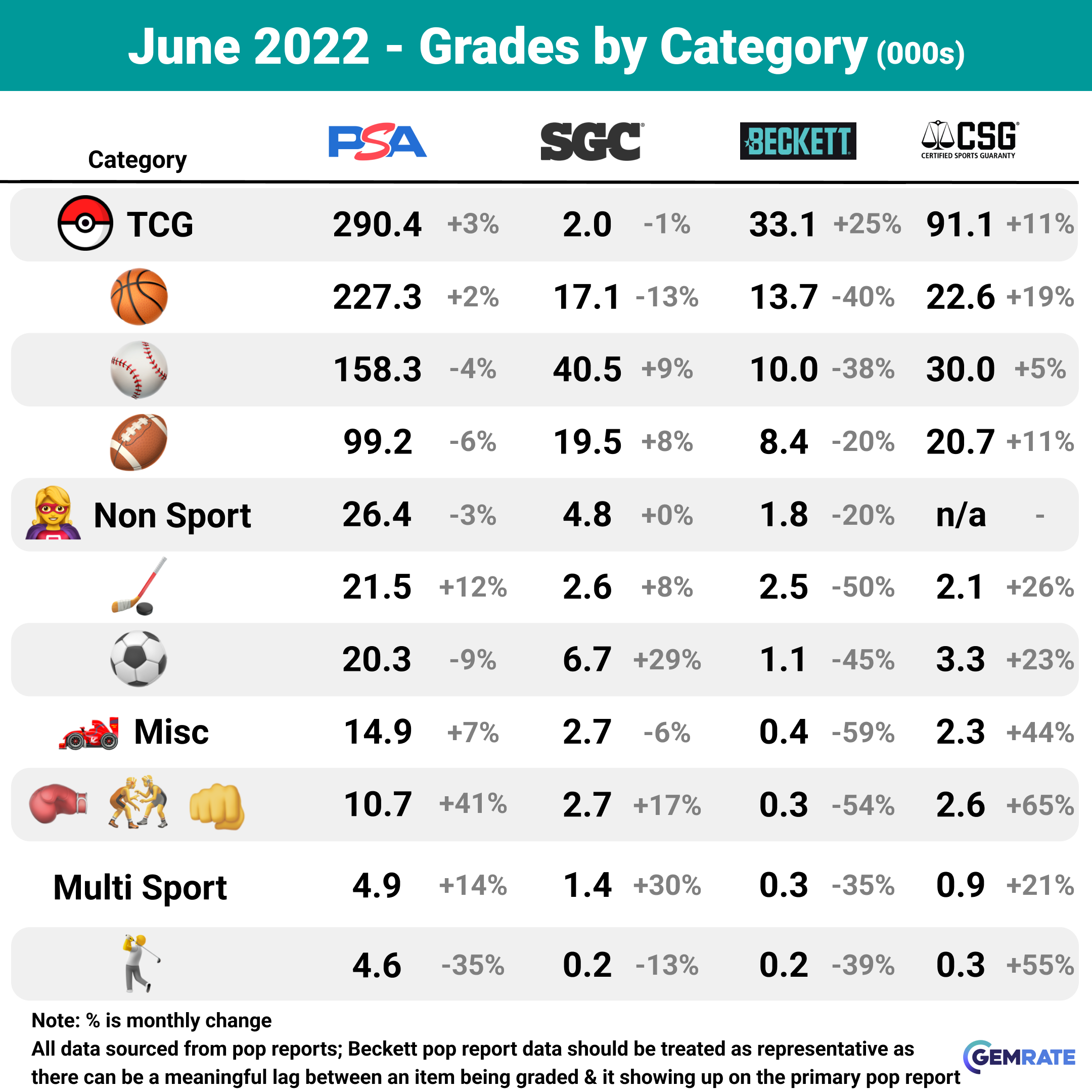

- TCG/Pokemon activity was up 6% across the major graders and continues to lead grading activity in 2022. For comparison, basketball (-2%), baseball (-3%), and football (-4%) all declined.

- Halfway through 2022 - PSA has graded 5.1 million items, SGC 558k items, and Beckett 442k items (CSG/CGC pop reports were not available at the start of 2022).

June Grading Summary

Items Graded - Weekly in 2022

Items Graded - 2022 YTD

Category Comparison

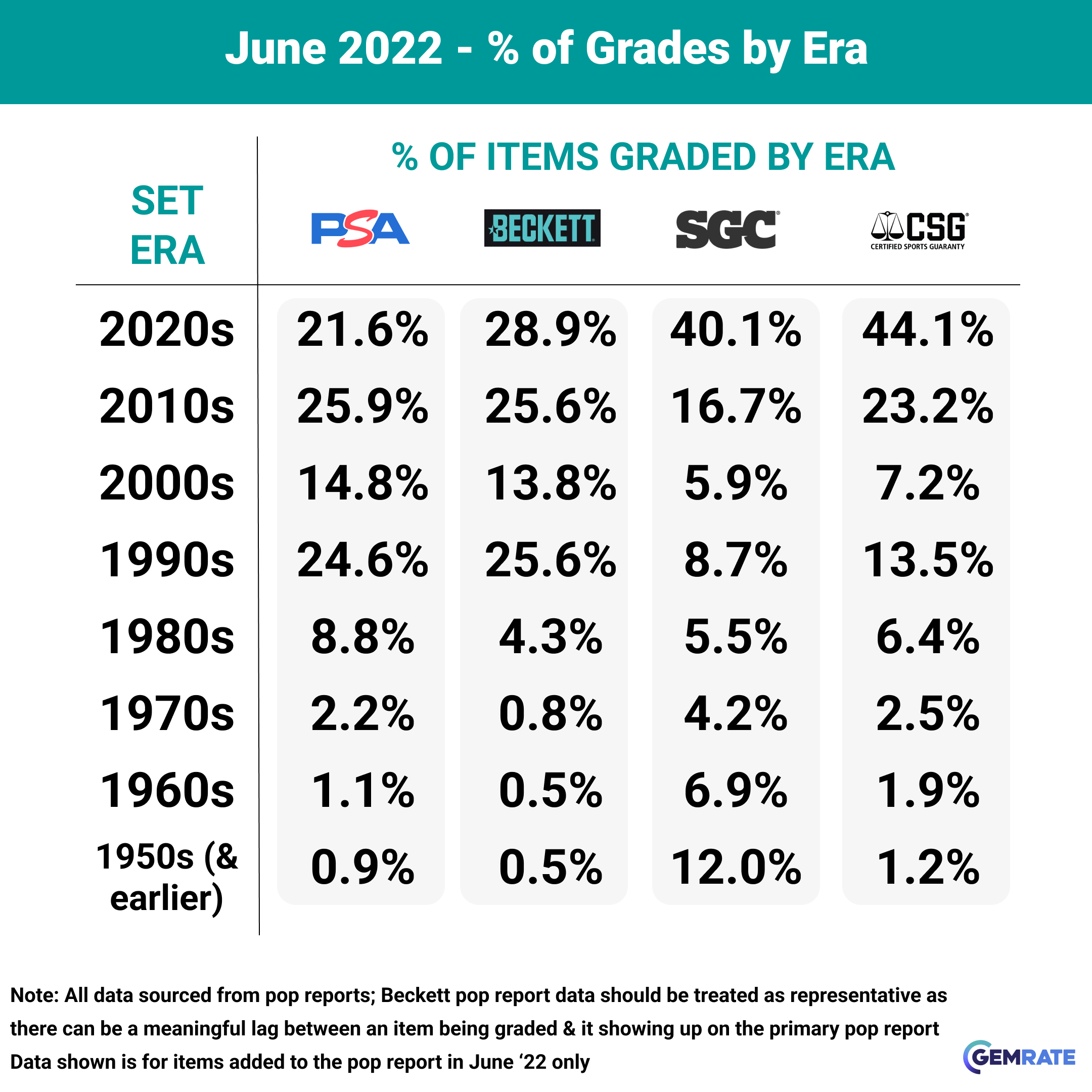

Items Graded by Era

Gem Rate Breakdown by Era

June 2022 PSA Grading Recap

- PSA graded 887,723 items during June - roughly flat vs May.

- TCG/Pokemon growth slowed significantly after a large spike in May - up only 3% (vs 92% in May).

- 40% of the items graded in June were from 1990s and 2000s sets (compared to 34% in May)

- Gem rates as a whole fell again - declining to 30% in June (vs 33% in May, 35% in April, and 40% in March).

Category Summary

TCG and basketball activity both increased slightly in June

- TCG, basketball, soccer, boxing/wrestling/mma, multi-sport and misc categories increased compared to May

Set Summary

TCG continues to top the list

- 1999 Pokemon Game held onto the top spot for the fifth straight month

- Added to the list in June: 1990 Marvel Universe and 1986 Fleer basketball

- Dropping from the list: 2020 Prizm and Mosaic football

Player Summary

More of the same at the top of the leaderboard

- Please note that this section was updated on 7/14/22 due to an error in the original analysis published on 7/5/22. GemRate recently added minor-league cards to the database and those were being incorrectly factored in the initial version published. Our apologies for the mistake.

- Micheal Jordan grading activity increased 18% approaching highs reached during 2021

- Added to the list in June: Mike Trout and Zapdos

- Dropping from the list: Ja Morant and Joe Burrow

Card Summary

The 2020 Swsh Black Promo Charizard has crossed 50k grades all time

- Added to the list in June: 2000 Pokemon Promo Black Star Pikachu and Pokemon S&S Vivid Voltage Jirachi

- Dropping from the list: Pokemon S&S Vivid Voltage Charizard and Celebi

What's Next for PSA?

- Themes for Collectors/PSA:

- Grading volume has been fairly consistent in 2022. June activity was flat with May and up 15% compared to last year.

- PSA continues to clear the backlog - which will be through grading in the next few weeks and shipped out over the next couple of months.

- Service levels have been re-opened on a limited basis and quickly expanded more broadly.

-

At a high level, PSA appears to be doing what they need to be doing. In a vacuum, these are all good things to see.

There's no question that Collectors and PSA have invested significant resources in streamlining and improving the business operations.

- That said, pressure to accelerate demand has to be increasing on the back of Collectors' fundraising announcement this spring.

Undoubtedly, PSA was a huge beneficiary from the surge in base cards graded. That phenomenon will likely be muted for the foreseeable future.

Given that, a major outstanding question is whether or not PSA has the ability to meaningfully stimulate demand - which appears to have slowed considerably from recent highs.

Does PSA have a big unlock available to them beyond pricing?

June 2022 SGC Grading Recap

- SGC graded 100,777 cards during June - a 5% increase vs May.

- Baseball continues to lead the charge - increasing 9% vs May - with grading activity now more than double the next closest category (football).

Category Summary

Baseball, hockey, wrestling/boxing/mma, and golf all grew by double digits in June.

Set Summary

No change at the top; vintage baseball resurfaces

- Added to the list in June: 2022 Bowman Chrome Prospects, 1958, 1959, and 1968 Topps baseball

- Dropping from the list: 2021 Donruss basketball, 2020 Mosaic, Donruss Optic and Select basketball

Player Summary

Top of the list holds steady

- Added to the list in June: Hank Aaron, Ken Griffey Jr and Mike Trout

- Dropping from the list: LaMelo Ball, Anthony Edwards and Mac Jones

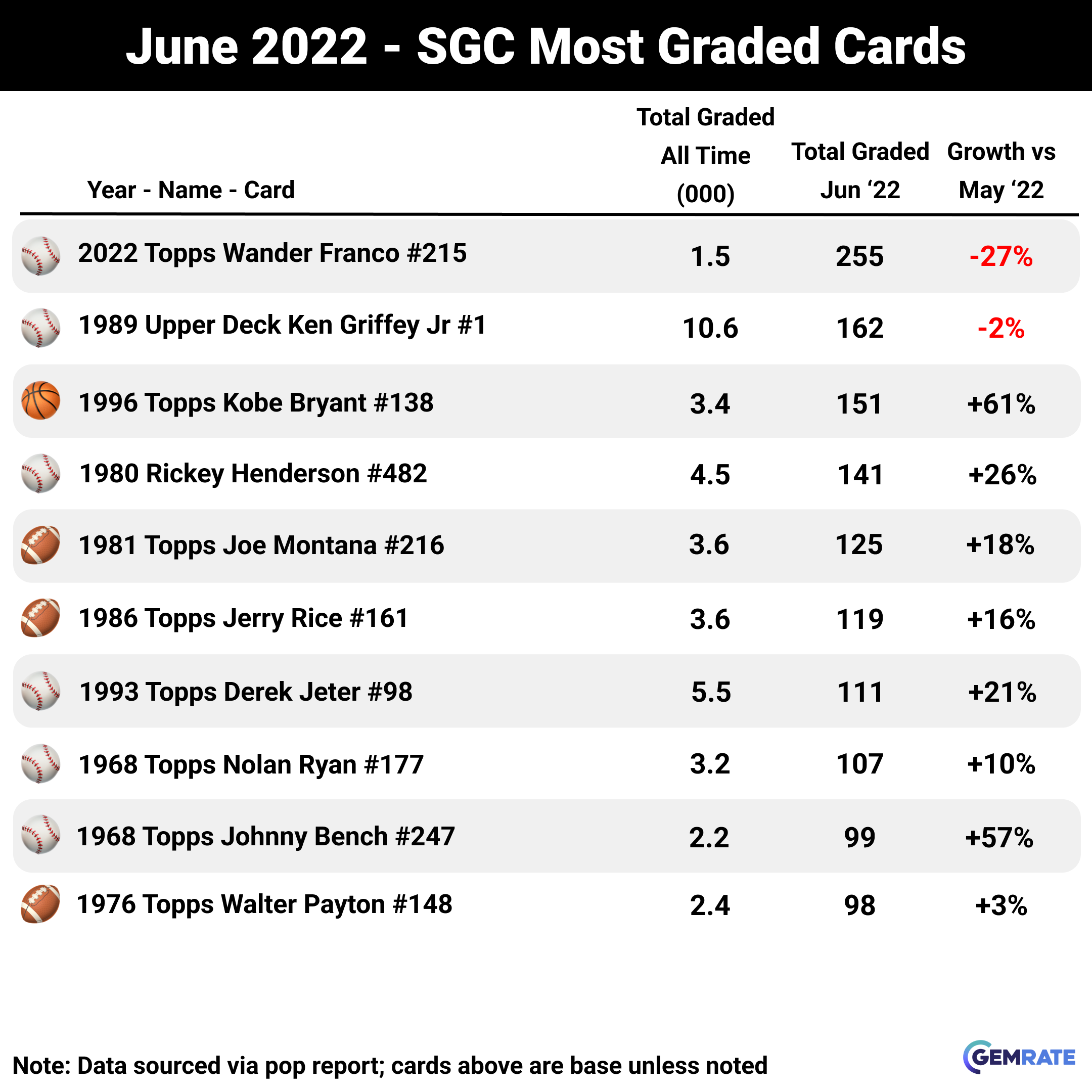

Card Summary

Baseball and vintage top the leaderboard

- The top three cards remain unchanged (again)

- Added to the list in June: 1993 Topps Derek Jeter #98 and 1968 Topps Johnny Bench #487

- Dropping from the list: 1968 Topps Mickey Mantle #280 and 1958 Topps Mickey Mantle All Star #487

What's Next for SGC?

- The competitive environment remains noisy - yet SGC continues to post modest improvements month over month.

The major question remains whether SGC's momentum will hold when PSA pricing becomes more competitive. Does SGC have another gear?

-

SGC is currently advantaged in turnaround times but still yields lower market returns on most items.

Given PSA is likely to open its $30 service level beyond club members sooner than later - we may not have to wait much longer to see if there is an impact on SGC demand.

-

A strong July would be a good sign for SGC that the market has not begun holding onto cards to send to PSA (that have more recently been sent to SGC).

Can SGC add to its offering ahead of changes from PSA?

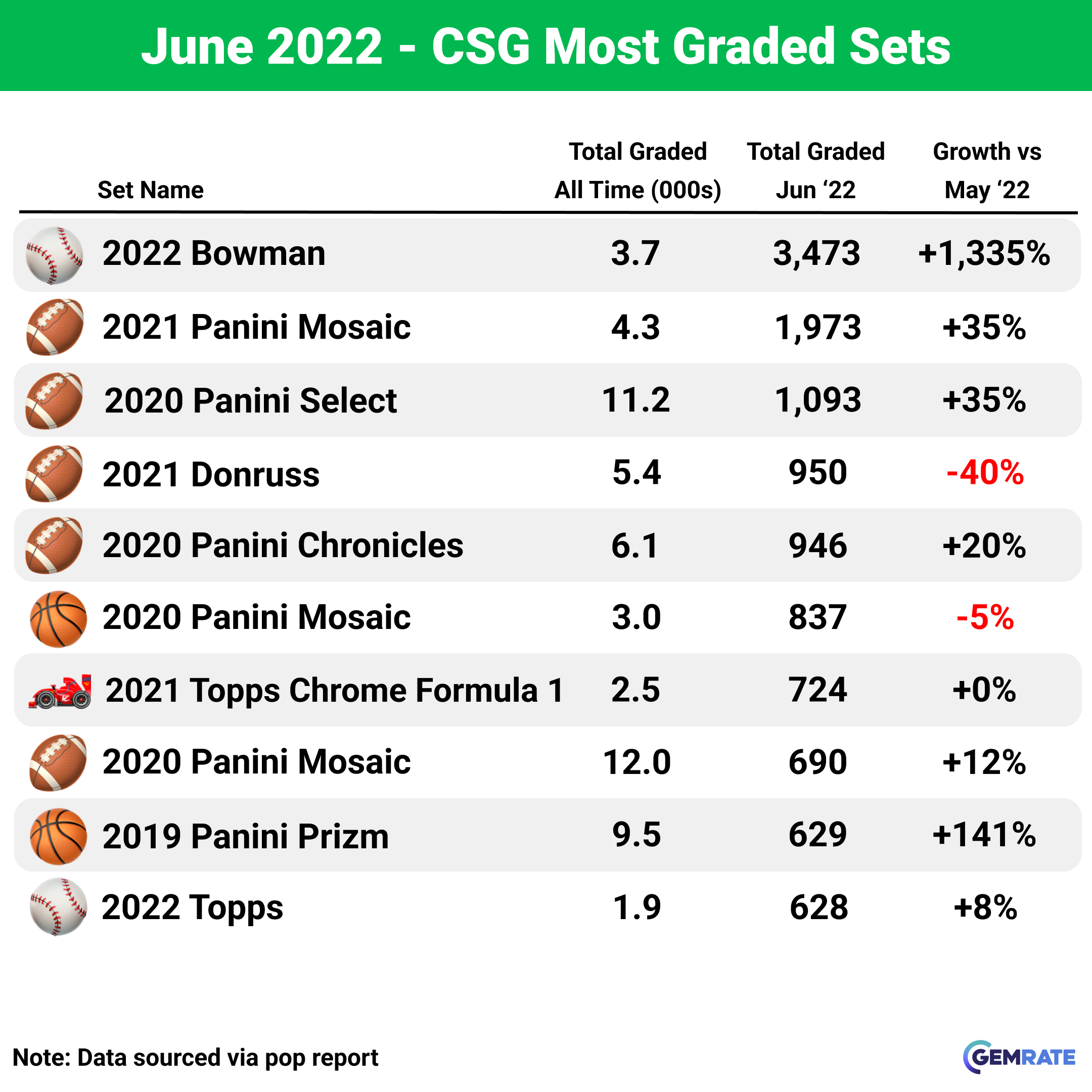

Other Charts - CSG

Category Summary

Set Summary

Player Summary

What's Next for CSG?

- CSG/CGC had a strong June relative to the rest of the major graders as CSG & CGC both outperformed overall grading activity.

Yet, the market seems to be in a wait-and-see period on the CSG side.

It's possible that the lower-end and ultra-modern baseball skew for CSG may be masking some of their market gains.

- Can heightened grading activity for CSG translate into greater market relevance and pricing?

Other Charts - Beckett

Category Summary

What's Next for Beckett?

- Beckett has cleared its backlog and is now on the hook to regain relevance in the current market.

Market frustration from Beckett's perceived disinterest in the hobby remains evident and there is some very real baggage for them to address.

- Despite several recent changes (new CEO, new branding, acquisitions), communication from the company remains minimal.

This leaves Beckett open for criticism from a hobby that is ready to lay into it for moves like jumping into VHS grading.

- Beckett needs to pull from Collectors' playbook - check operational boxes, start to overcommunicate and rebuild trust.

News around Beckett innovation is likely to fall flat until they get some of the basics in order and help paint a better picture of their vision for the hobby - one where Beckett shows it's aligned with collectors and backs it up with improvements.