October 2021 Recap

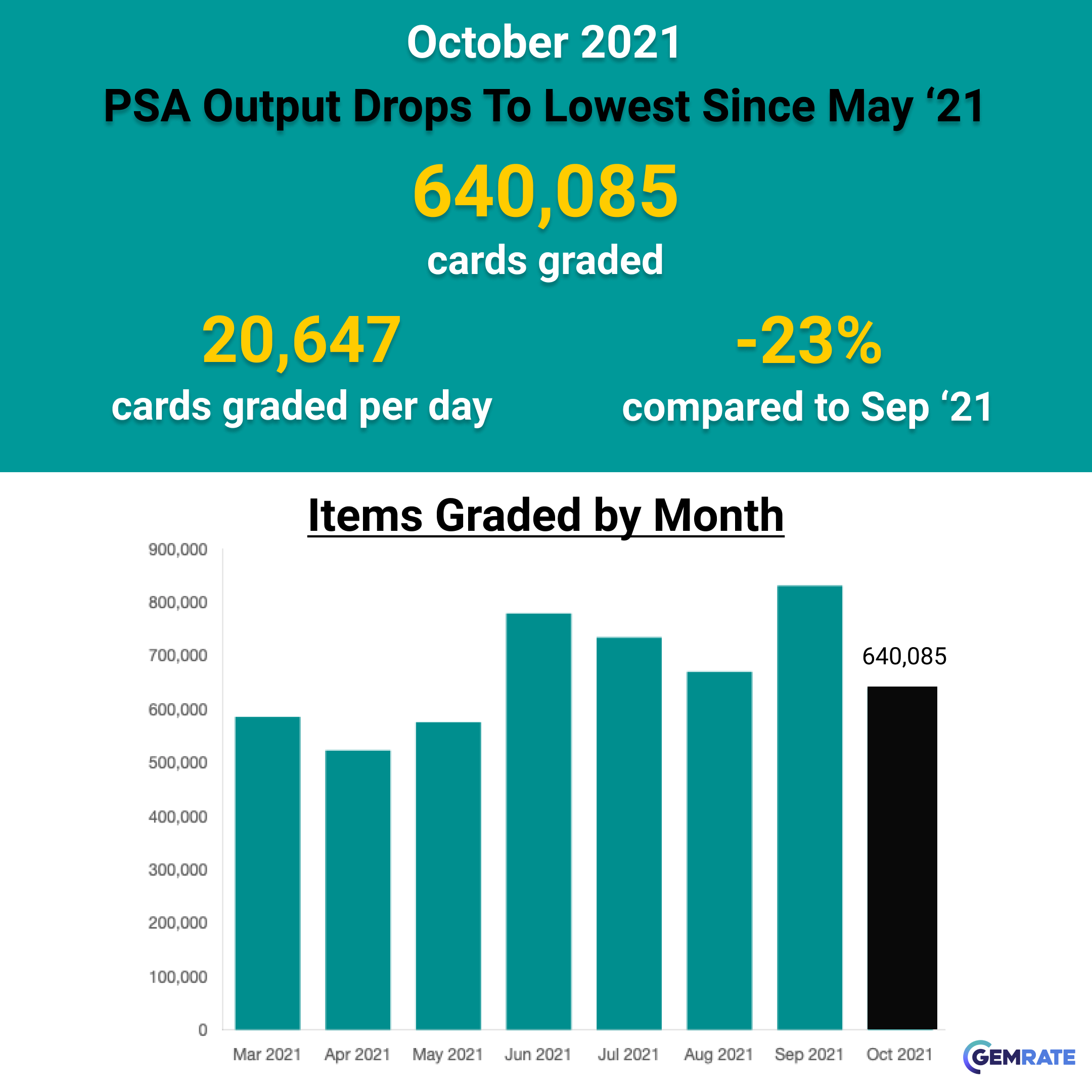

PSA grading activity declined considerably to 640k cards graded (down 23% vs September) and was the lowest monthly output since May ‘21.

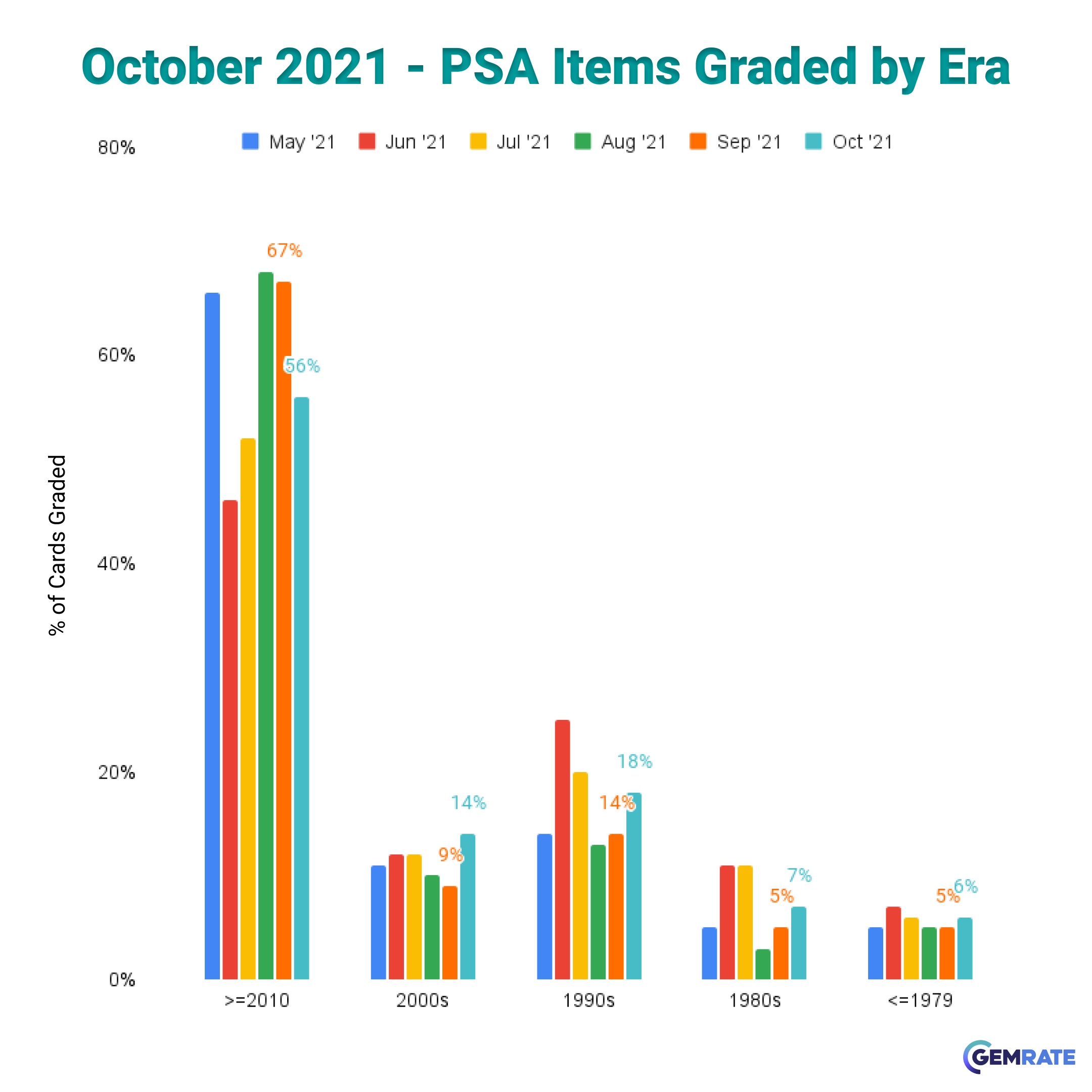

PSA used October to catch up on lower price submissions (following September’s record output) - highlighted by a noteworthy drop in the percentage of cards graded after 2010.

TCG (Pokemon) was the top graded category for the first time and was the only major category to post an increase in volume compared to September.

On a like-to-like basis, gem rates mostly held at the more recent elevated levels; however, the overall gem rate across all cards declined thanks in large part to the mix shifts noted above.

Published November 1st, 2021

PSA output declined by 23% in October compared to September - with 640,085 items graded during the month

The October output is a sharp decline from the record highs reached in September (830k) and is the lowest monthly volume since May '21

The average output per day was 20,647 items graded

Cards from the 1990s and 2000s increased as a % of cards graded during October

Gem rates remain favorable vs spring '21; overall gem rates drop due to the shift away from ultra-modern

The gem rate across all cards graded dropped to 38% in October (vs 43% in September and 40% in August). However, a closer look shows this decline can be attributed to the large shift in the mix of cards graded.

Of the top 100 cards graded, 46% saw an improvement in their gem rate during October compared to September.

2019 Prizm basketball gem rates continue to see an atypical climb and were 60% in October.

Category Summary

TCG tops the leaderboard for the first time and was the only major category to show an increase in October

TCG increased 6% vs September

Basketball and baseball experienced significant declines in volume; basketball activity alone was down by more than 100k grades vs September

Set Summary

1999 Pokemon Game surpasses 2019 Prizm basketball as the top graded set

All of the top sets showed a drop in activity during October - including Pokemon - despite overall category growth for TCG

Player Summary

Jordan holds onto the top spot

Only Jordan, Kobe, and Shaq outpaced overall activity (down 23%)

Card Summary

Pokemon surges and now makes up half the October leaderboard

What's Next?

Was October a blip or is there more to it? Is this just a reset after a record push in September and a big push to close out the year?

Is it any coincidence PSA very recently touted its capacity growth allowing it to process (not necessarily grade) 40,000+ cards per day?

Does the higher mix of Pokemon cards somehow impact PSA's ability to process cards at a rapid pace?

Does this impact the potential reopening of a service level before year end? (unlikely as the higher mix of TCG cards isn't a surprise to PSA)